It is said that Customs duty is the price paid for the privilege of crossing borders, a metaphoric international toll gate. In the Nigerian shipping industry, this privilege of international trade has become increasingly exorbitant. It is no longer news that the Customs duty rate has increased several times since the year 2024 began. The implications of this are far-reaching on the economy, and stakeholders in general.

This paper shall evaluate the impact of increased Customs duties on the Nigerian economy, acknowledging the complexity involved and recommending relevant solutions to promote economic growth and protect the interest of maritime stakeholders in the country.

Customs duty is the tax imposed on imports and exports of goods. Section 281 of the Nigerian Customs Service Act of 2023 (‘the Customs Act’ or ‘the Act’) defines it as:

“The duties provided for in the customs tariff to which goods are liable on entering or leaving the customs territory and includes other Customs duties collected on behalf of other government agencies.”

This statutory definition maps out the scope of the duties and encompasses taxes levied on imports by other government agencies. Generally, goods being imported or exported from all airports or seaports (like Tincan Island, Apapa Wharf, and Onne ports) or Stations in Nigeria are subject to Customs Duties. Some goods are statutorily exempt from duties[1] and Customs concessions[2].

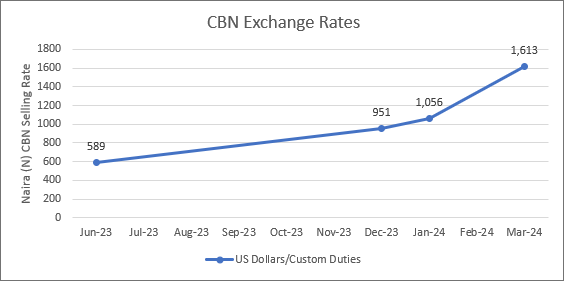

Importantly, the determination of import duties in Nigeria hinges on the exchange rate between the Nigerian Naira (NGN) and the United States Dollar (USD). Nigerian law mandates the Nigerian Customs Service (NCS) to adhere to the Central Bank of Nigeria’s Foreign Exchange Manual (Revised Edition) 2018. Consequently, the NCS employs the prevailing foreign exchange (FX) rate for the US Dollar (USD) as established by the Central Bank of Nigeria (CBN) when calculating import duties on incoming goods.

Notably, in May 2023, the CBN transitioned to a floating foreign exchange rate system based on a Willing Buyer- Willing Seller trading principle,[3] allowing the rate to fluctuate based on market forces. This shift has demonstrably impacted import duty rates, leading to a significant upward revision. For instance, the official CBN exchange rate in June 2023 stood at NGN 422.30 per USD 1. However, by March 2024, this rate had nearly quadrupled to NGN 1538.74 per USD 1. Consequently, the depreciation of the Naira relative to the Dollar has resulted in a corresponding increase in import duty costs.[4]

In response to the accusations of exploitation, the NSC released a statement that it had not raised duties paid on imports, but only aligned with the foreign exchange rate prescribed by the CBN.[5]

[1] Nigeria Trade Information Portal, ‘Guidelines for Accessing of Import Duty Exemption Certificates (IDEC) and Refunds of Custom Duty’. Available at: https://nigeriatradeportal.fmiti.gov.ng/procedure/625/step/2254.

[2] Nigeria Customs Service, ‘Passenger’s Concessions’. Available at: https://customs.gov.ng/?page_id=3073.

[3] CBN Trade and Exchange Department Circular dated 23rd February 2024

[4] Anagor-Ewuzie, A. (2024) CBN raises Customs duty rate by 2.6% for the fifth time in 2024, Businessday NG. Available at: https://businessday.ng/news/article/cbn-raises-customs-duty-rate-by-2-6-for-the-fifth-time-in-2024/.

[5] Vanguard Newspaper, ‘We didn’t raise import duty – Nigeria Customs’ (2024) Available at: https://www.vanguardngr.com/2024/01/we-didnt-raise-import-duty-nigeria-customs/.

Source: Central Bank of Nigeria[1]

Who pays this Duty?

Customs duties are paid by importers and exporters, as prescribed by section 281 of the Customs Act.

The Act defines an “exporter” to mean any person who, at the time of exportation —

(a) owns any of the goods exported.

(b) carries the risk of any goods exported.

(c) represents the exporter or owner of any goods exported.

(d) actually, takes any goods out of the customs territory with the intention

to export such goods.

(e) is beneficially interested in any goods exported; or

(f) bears ultimate legal liability for the exportation of goods.

The same Section further provides that an “Importer” is one who.

(a) at the time of importation owns any goods imported.

(b) carries the risk of any goods imported.

(c) represents the importer or owner of any goods imported.

(d) actually, brings any goods into the customs territory with the intention

to import such goods.

(e) is beneficially interested in any goods imported; or

(f) bears ultimate legal liability for the importation of goods.

The Act expressly alludes responsibility to the proprietary owner, beneficial owner, risk bearer, the owner’s representative and legal liability bearer of the goods being imported or exported.

Customs duties are a cornerstone of Nigeria’s economic and trade policies. They serve a multitude of purposes, including generating revenue for the government through import and export taxes, enforcing international trade agreements, and promoting local industries. Additionally, customs duties ensure importers comply with regulations, facilitating the smooth release of goods.

On February 23rd, 2024, the CBN issued a new policy impacting customs import duties. The policy states that the exchange rate used to calculate customs duties will now be based on the closing foreign exchange rate on the date an importer opens a Form M.[2]

This change aims to bring more predictability to the customs duty assessment process.[3] However, the previous fluctuating increases in import duties have sparked concerns due to the rise in the overall cost of goods imported into the country. This has impacted both foreign producers and Nigerian consumers alike, resulting in many businesses moving to utilize neighboring ports, which have lower customs fees and leading to a decrease in trade volumes at the Nigerian ports.

Furthermore, the rapidly fluctuating exchange rate and rising duties have created uncertainty for importers and freight forwarders, hindering business planning. We note that increased duties will generate revenue for public services and infrastructure development, however, the increase in revenue can only foster economic growth if it is allocated strategically. Therefore, striking a balance between the objectives of the Nigerian government and the growth of businesses is crucial for ensuring a healthy and sustainable Nigerian economy.

Conclusion

A possible solution to resolve this conundrum would be the effective implementation of regional trade agreements like the ECOWAS Charter and the AFTCFA In addition, the development and investment in more Free Trade Zones (FTZs) across Nigeria is also encouraged. These zones, like the Lagos Free Trade Zone, Nigeria International Commerce City (Eko Atlantic), Calabar Free Trade Zone, and Dangote Industries Free Zone Development Company, offer various benefits for businesses. By investing in these zones, the government can create an attractive environment that fosters trade and economic activity as goods admitted into the Free Trade enjoy exemption from or repayment of import duties when exported.[4] Policymakers are encouraged to carefully consider the relevant stakeholders and strike a balance that promotes economic growth, supports domestic industries, and ensures the welfare of all.

[6] Central Bank of Nigeria, Weighted Average Rate – Nigerian Foreign Exchange Market (NFEM), Accessed at https://www.cbn.gov.ng/rates/ExchRateByCurrency.asp

[7] A Form M is a document required by Nigerian authorities for the importation of goods.

[8] CBN Trade and Exchange Department Circular dated 23rd February 2024

[9] See Section 139 of the Customs Act